Rumored Buzz on Hiring Accountants

Table of ContentsWhat Does Hiring Accountants Mean?Not known Incorrect Statements About Hiring Accountants The Ultimate Guide To Hiring AccountantsRumored Buzz on Hiring AccountantsSome Known Facts About Hiring Accountants.

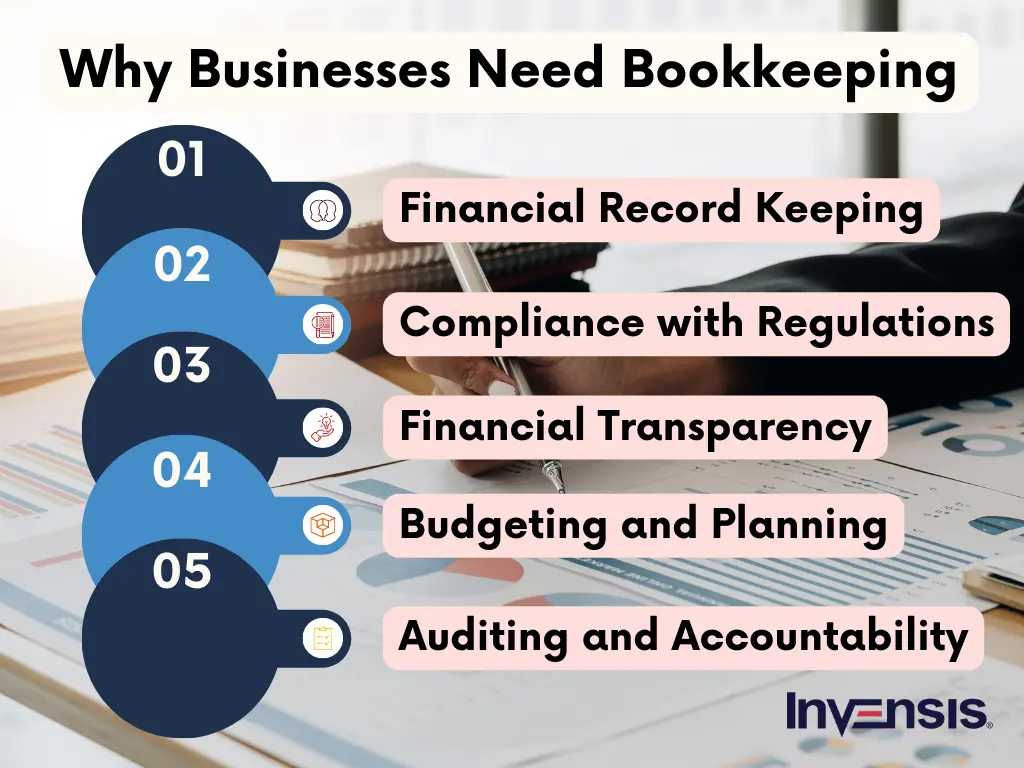

Is it time to hire an accountant? From streamlining your tax returns to assessing finances for improved productivity, an accounting professional can make a large distinction for your company.An accounting professional, such as a state-licensed accountant (CPA), has actually specialized understanding in monetary administration and tax obligation compliance. They keep up to day with ever-changing regulations and best methods, ensuring that your organization stays in compliance with lawful and governing demands. Their knowledge enables them to navigate complex economic matters and offer accurate reputable recommendations customized to your certain organization needs.

They can also link you with the appropriate application groups so you understand you're establishing everything up appropriately the initial time. For those that don't already have an accountant, it might be challenging to know when to get to out to one - Hiring Accountants. Nevertheless, what is the tipping point? Every service is different, yet if you are encountering difficulties in the complying with locations, currently might be the correct time to bring an accounting professional on board: You do not have to compose a company strategy alone.

How Hiring Accountants can Save You Time, Stress, and Money.

.jpg)

The stakes are high, and an expert accountant can aid you get tax advice and be prepared. We recommend speaking to an accounting professional or various other money professional regarding a number of tax-related goals, consisting of: Tax preparation strategies.

By functioning with an accountant, businesses can strengthen their finance applications by offering extra accurate financial information and making a better situation for economic practicality. Accounting professionals can likewise help with tasks such as preparing financial papers, evaluating economic information to analyze credit reliability, and developing a thorough, well-structured loan proposal. When things change in your service, you wish to ensure you have a solid handle on your finances.

Are you all set to offer your company? Accounting professionals can assist you identify your company's worth to assist you secure a fair deal.

The Main Principles Of Hiring Accountants

Individuals are not needed by legislation to keep monetary books and documents (businesses are), however refraining this can be an expensive mistake from an economic and tax obligation point of view. Your financial institution account and charge card statements might be incorrect and you might not find this till it's far too late to make corrections.

Whether you require an accountant will certainly most likely depend on a couple of elements, including how difficult your taxes are to submit and the amount of accounts you have to handle. This is an individual that has training (and likely a college level) in audit and can handle bookkeeping tasks. The per hour rate, which once again relies on location, task description, and expertise, for important source a self-employed accountant is see this website concerning $35 per hour typically however can be considerably extra, even up to $125 per hour.

Not known Details About Hiring Accountants

While a CPA can supply bookkeeping solutions, this professional might be also pricey for the task. For the jobs explained at the beginning, a personal bookkeeper is what you'll require.

It syncs with your savings account to streamline your individual funds. Both Quicken and have mobile applications to record information on the fly. You can collaborate with an accountant to aid you begin with your personal audit. Try to find a person experienced in the software application you prepare to utilize. The bookkeeper can set up accounts (which operate like folders) that you place your information in.

The accountant can likewise assess your work regularly (e.g., quarterly) to make certain you're taping your income and expenditures correctly and resolving your copyright appropriately. However, you choose to handle your personal accounting, be certain to divide this from accounting for any organization you own. Develop the expense of this bookkeeping right into your household spending plan.

Rumored Buzz on Hiring Accountants

As tax obligation season methods, individuals and businesses are confronted with the seasonal question: Should I tackle my tax obligations alone or work with a specialist accounting professional? While the appeal of saving money by doing it on your own may be alluring, there are engaging reasons to think about the expertise of a qualified accounting professional. Here are the top reasons employing an accounting professional might be a wise investment compared to navigating the complex globe of tax obligations on your very own.

Tax obligations are complex and ever-changing, and a seasoned accounting professional remains abreast of these modifications. Their competence makes sure that you benefit from all available reductions and credit scores, ultimately maximizing your prospective tax cost savings. Completing your very own tax obligations can be a time-consuming and labor-intensive process. Working with an accounting professional releases up your time, permitting you to concentrate on your personal or use this link service activities.